Plans for every kind of business

Now with Live Assisted Bookkeeping (add $50/month)

- Add $50 per month

- Add $50 per month

- Add $50 per month

- Add $50 per month

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Add $50/month

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

- Live Assisted Bookkeeping

- Live Full-Service Bookkeeping

Ready to get started?

Or call 1-800-365-9606

All plans include

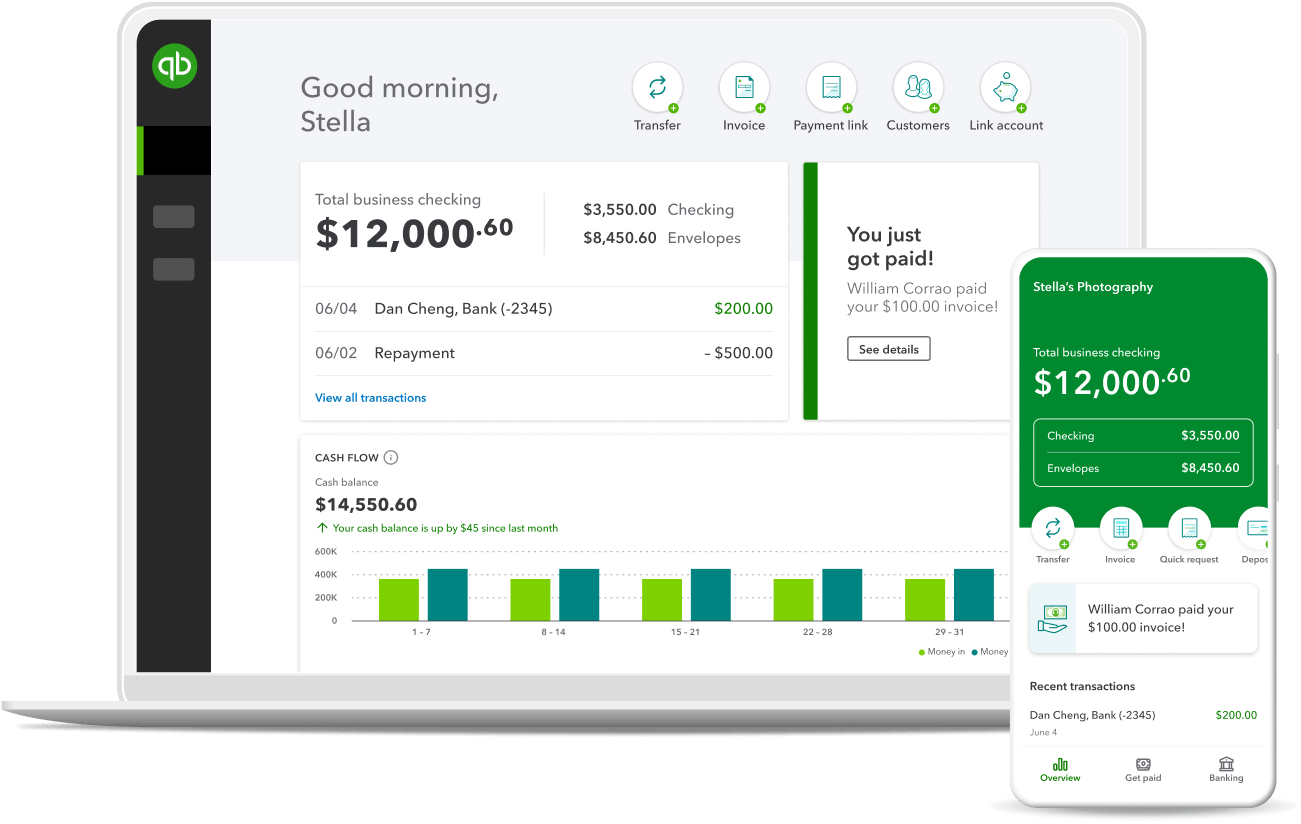

Mobile app

QuickBooks comes with a mobile app that help you run your business on the go—anytime, anywhere.

QuickBooks support

A member of our support team is ready and available to answer your QuickBooks questions.

App integration

Use the apps you know and love to keep your business running smoothly.

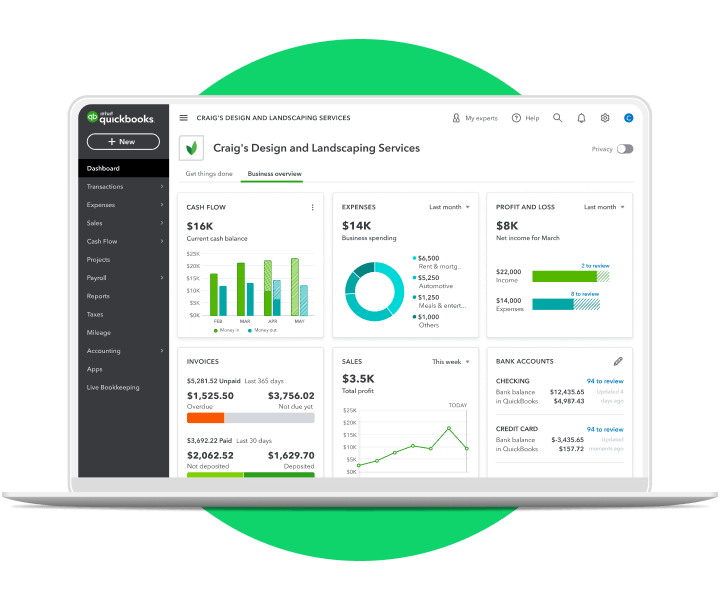

See QuickBooks in action

Try QuickBooks for free with our test drive. You don’t even need a credit card.

We cover all kinds of businesses

Currently using QuickBooks?

Looking to purchase QuickBooks Online for more than one company? Call (800) 595-4219 for a multi-company discount. Buy two or more QuickBooks Online subscriptions and get 50% off for 12 months*